- Early

- Posts

- Your Path to C-Suite Success: Navigating The Startup Stages - Part 1

Your Path to C-Suite Success: Navigating The Startup Stages - Part 1

From Pre-Seed to Series A - Mastering the Early Stage Startup Journey

JOB SEARCH STRATEGY

STARTUP STAGES 101.

This Tuesday, I had an incredible conversation with the Head of Talent at a VC firm boasting $3.2B in assets under management.

She shed light on a critical issue for the founders of their portfolio companies: determining if a candidate is truly “startup ready”.

Why is this such an issue?

I’ll give you an example.

THE GOOGLE EXEC DILEMA.

A senior leader at Google wants to become a VP or join the C-Suite at a startup.

Here are the issues:

Compensation Gap: Trading a $1M+ comp package for significantly lower startup pay brings lots of considerations with it.

Operational Shift: Moving from high-level management to intense, hands-on work is something many are not excited to get back into.

What happens next? Two scenarios:

The Retreat: Realizing the stark differences, they often return to their comfort zone.

The Reality Check: For those who leap, the intense startup environment either leads to voluntary exit or, in less fortunate cases, termination.

This misalignment drains startups of two critical resources: time and money.

This could have been avoided had they known the reality of each stage in a startup company’s journey and what it looks like for employees on the ground.

And this isn’t just the case for executives.

It’s true for anyone looking to enter any stage of startup they haven’t had exposure to.

If you’re looking to join a startup, you must know the details of what you’re getting yourself into to decide whether it’s right for you.

And…

So you can lean into the unique qualities of each stage to stand out as a stellar startup-ready candidate to the hiring team.

So, let’s dig into what’s considered “early-stage startups” and do an overview of Pre-Seed, Seed, and Series A.

What are the characteristics?

What are the pro’s and con’s of each stage?

Who is each stage right for?

Let’s explore the startup lifecycle together!

PRE-SEED

The Idea Incubator.

Startup Snapshot: At the Pre-Seed stage, startups are typically in the idea phase. Often, it’s legitimately just one or two people with an idea they think will work. They may not have a prototype yet and are usually working on conceptualizing their product or service. There are likely no customers and no revenue.

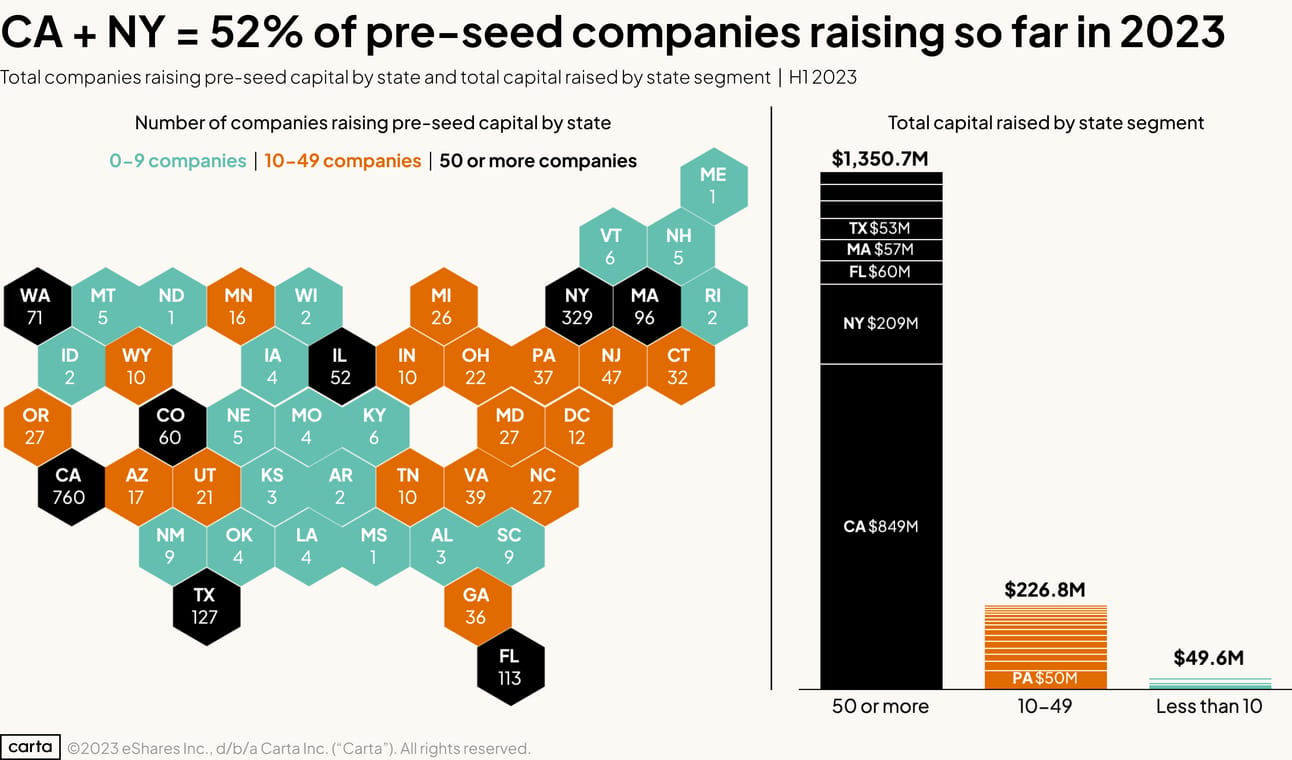

Funding: Funding is often less than $1 million, primarily from friends, family, or angel investors. This is when you hear the term “friends and family round” because the founder(s) often ask those closest to them to invest in their company to get it off the ground.

Product: Just an unproven concept. An idea.

Team: Small… We’re talking tiny. Often just the founders.

Customers: None yet. The founders are likely speaking with those they think would be customers to understand how best to position, offer, and build their solution.

Revenue/Profit: Because this is just an idea at this stage, the startup often hasn’t made any money.

Success Rate: 20% of pre-seed companies fail in their first year. Only 10% of pre-seed companies raise a Seed round of funding. For some, they only need the initial money to start the business and get the revenue engine running. For most, it’s because the idea doesn’t take off, and they need to pivot to something else.

Pros of Joining:

Creative Freedom - Lead and shape the foundational vision and work on your product and mission you think could change the world.

High Impact - Direct influence on company direction and culture.

Equity Potential - Significant stake in the company's future success.

Zero to One Experience - Likely to be considered a co-founder.

Cons of Joining:

High Risk - Uncertain future with limited financial security.

Resource Constraints - Limited funding and manpower. You need to be scrappy.

Intense Workload - Expect long hours and multitasking. There’s no one to rely on but yourself.

What This Means For Job Seekers: Unless you are a founder, you will not likely join a pre-seed company. If you are looking to join a pre-seed company, you’ll either need to keep your day job and work on it on the side (aka working two jobs), do something else on the side like consulting, or have some financial cushion so you’re able to work with little to no income.

SEED

Cultivating The Vision.

Startup Snapshot: Once a company has secured Seed stage funding, it’s time to assemble a small, scrappy team and build and test your MVP to determine if the founders’ vision is a need in the world and something people will be willing to pay for.

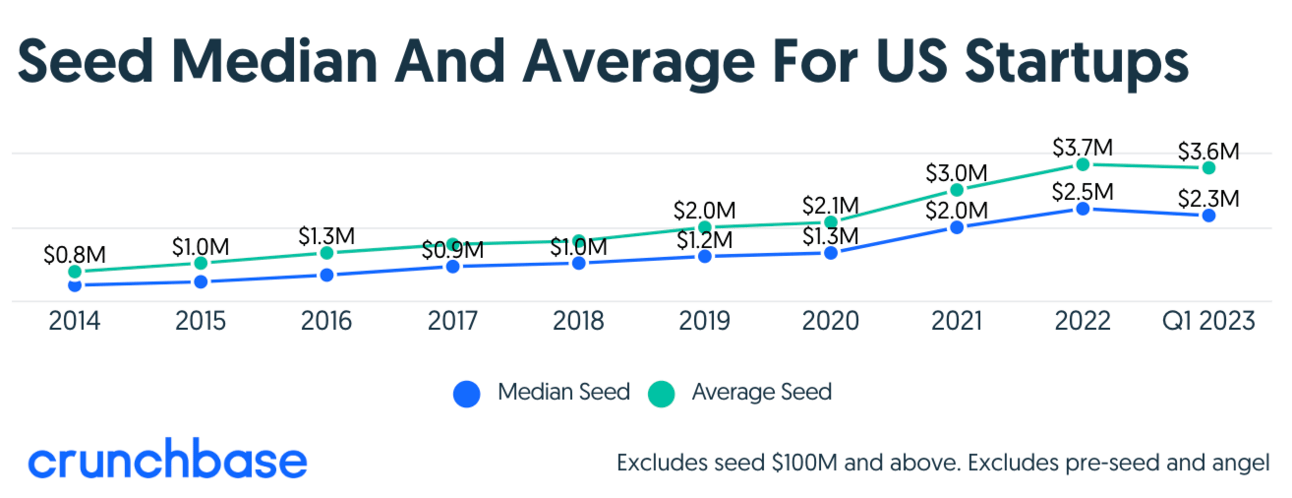

Funding: At this stage, the VC firms have little to no numbers to go off of, so they’re betting on the founders. The average investment at the Seed stage is anywhere from $1M to $3M. In rare cases, the founders can raise over $3M, sometimes even hundreds of millions (although when numbers get that high, it’s more like skipping the seed and going straight to later stages of funding).

Product: The Seed stage is all about figuring out what people will be willing to pay for, so all the focus is on product development and the release and adjustment of a minimum viable product (MVP).

Team: Typically, no more than 20 people are working in the company at the Seed stage. The team has raised some money and can now go out and hire critical first-team members. This likely includes engineering, development, and technical talent, as well as salespeople and junior generalists. The senior-level talent involved with seed-stage companies are often advisors or contractors because they are expensive.

Customers: The company is starting to put its MVP (minimum viable product) or early product versions into the world to determine if it’s something people would actually pay for. They may have a few paying customers, but most of what they do during the Seed stage is market research.

Revenue/Profit: Most companies aren’t making any revenue. Some can hit product market fit (aka create a product people want) early and have annual revenues in the hundreds of thousands of dollars.

Success Rate: Only 10% of Seed-stage startups are able to raise a Series A. Once a company closes its Seed round, it will likely look to raise a Series A within 12 to 18 months.

Pros of Joining:

Early Influence: Mold the company's products and go-to-market strategies.

Agile Environment: Flexibility in decision-making and strategy pivoting.

Team Building: Opportunity to build and lead the initial team.

Cons of Joining:

Market Uncertainty: The product-market fit may still be unproven.

Funding Pressures: Continuous need to secure the next funding round.

Operational Challenges: Establishing processes from scratch.

What This Means for Job Seekers:

In General: Direct exposure to founders, investors, fundraising, customers, and the initial stages of company building is amazing for anyone with dreams of starting their own company and fast-tracking their experience and exposure to all facets of startup life. However, it’s not guaranteed you’ll see best practices, get mentorship, or be surrounded by people who have done it before. There’s a lot of individual effort, very small teams, and few resources. If you get in at the Seed stage and the company becomes a multi-billion dollar valuation or exit you could be sitting on millions in equity. But beware… only 10% of companies get out of this stage, so that equity may not be worth the paper it’s printed on.

Junior Talent: This stage offers a wide variety of experiences in different departments. You can often get a job by showing enthusiasm and willingness to do anything.

Mid-Level Talent: A great place to position yourself to lead a division of a company because the division will be just one or two people… or maybe just you.

Executive Talent: You’ll be getting your hands dirty as an operator with the hopes that the company scales and you can hire a team around you. Cash is king, so don’t expect a salary higher than $200k.

JOB SEEKER TIP: When looking to join a Seed company the best approach is to look at what the best Seed investors look for when before investing millions of dollars into a company. The best place I have found that lays out the details of what to look for in companies at this stage is Initialized Capital’s approach, especially the “Questions We Ask”. If you’re interested in joining a Seed stage company I highly recommend clicking here and reading about what to look for when searching for Seed companies and the questions to ask yourself before joining.

SERIES A

SETTING THE STAGE FOR GROWTH.

Startup Snapshot: Once they reach the Series A stage, the company likely has a minimum viable product (MVP) and some level of product market fit. They’re ready to focus on growing their team and small customer base and identifying how they’re going to do one critical aspect of business… actually make money!

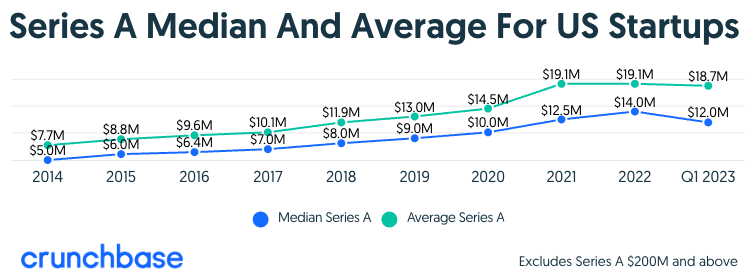

Funding: Series A’s can be all over the place but, on average, sit in the $12 million to $15 million range. Series A checks increased significantly in ‘21 and ‘22 when cash was cheap and everywhere but appear to be returning to pre-pandemic levels.

Team: With more money and a better idea of company direction, the founders will hire their first specialists. These teams are anywhere from 20 to 60 people, so people from the initial team will become managers or managers will be hired.

Customers: Once a company reaches Series A, the goal is to expand the customer base and get more customers to use (and hopefully pay for) the product.

Revenue/Profit: It’s easy to give things away for free. But the most important goal is to have a clear plan for how the company will make money. Investors are going to want to see 15% to 20% monthly growth. Sustained over a year, the company will grow 4x to 8x per year.

Success Rate: Similar to the journey from Seed to Series A, the company will look to close its Series B funding in 10 to 18 months after the Series A raise. According to SPD Load, 35% of Series A companies fail to raise Series B, meaning that 65% of companies survive and advance. Much better odds than the 10% from Pre-Seed to Seed and the 10% from Seed to Series A.

Pros of Joining:

Scaling Impact: Drive significant growth and market positioning.

Professional Development: Lead and grow a more substantial team.

Increased Resources: More funding to execute ambitious plans.

Cons of Joining:

Escalating Expectations: Investors and stakeholders demand results.

Cultural Shifts: Balancing startup agility with process structure.

Competitive Landscape: Navigating a more established market.

What This Means for Job Seekers:

In General: If you’re looking to get the full early-stage startup experience with a good salary, a little less risk, more resources, and a clearer path to success, then Series A is an excellent spot. The company likely has enough cash to allow you to do your job for at least a year before they raise more money, and if they hit it big, your equity will still be worth a lot. But remember that while a big equity payout would be nice, you should optimize for experience, exposure to higher-level strategy, working on a product you believe in, doing work you enjoy, and building a well-connected network of A-players. Any equity payout is far from guaranteed.

Junior Talent: More management and mentorship from leaders in the company and more resources to be able to do your job.

Mid-Level Talent: This is an amazing place to make a leadership jump in your career. Often Senior Managers at larger organizations can become Department Heads, VPs, or even join the C-Suite.

Executive Talent: With more specialization, larger teams, and more money, the founders will be looking for more executive-level talent. However, it’s put up or shut up in these roles because of how much there is to prove and how little time the company has. It’s very clear whether you’re driving results or not, and if you’re unable to deliver quickly, you may be looking for a new job just as fast.

MY JUMP FROM SR MANAGER TO VP: I worked at Uber for 7 years. I spent 4 of those 7 years as a Manager and 3 as a Senior Manager. I was never able to break into the General Manager tier of leadership. But, after Uber I wanted to be on the path to COO or Founder/Co-Founder and the best place I would be positioned to do that was in an early-stage startup. I was able to go from Senior Operations Manager at Uber to VP of Operations of a Series A startup with a significant increase in responsibility, exposure and access to leadership, and… pay.

OPEN ROLES

Who’s Hiring?

What They Do: Together.ai provides a platform where people can easily work on and improve artificial intelligence (AI) projects. It's designed to help researchers and businesses use and contribute to AI development through user-friendly tools and open-source models.

Number of Employees: 40

Total Raised To Date: $126.50M

Last Known Valuation: $100M

Last Raise Date: November 29, 2023

Recent Raise: $102.50M

Series: A

Pitchbook Success Probability: 95% Success

Open Roles: Careers Page

Departments Hiring Right Now:

Engineering

Sales

Research

What They Do: GreyOrange creates a platform that uses robotics and AI to help improve how online orders are processed in warehouses. Their technology makes the process faster and more accurate, which helps businesses save money and keeps their customers happy.

Number of Employees: 894

Total Raised To Date: $292.80M

Last Known Valuation: $700M

Last Raise Date: November 24, 2023

Recent Raise: $103.32M

Series: C+

Pitchbook Success Probability: 98% Success

Open Roles: Careers Page

Departments Hiring Right Now:

Engineering

Sales

Business Operations

What They Do: BlueVoyant is a cybersecurity company that provides businesses a platform to protect against online threats by continuously monitoring and securing digital networks and endpoints. Their services focus on detecting and preventing cyberattacks, helping companies maintain a strong and secure digital presence.

Number of Employees: 700

Total Raised To Date: $725.50M

Last Known Valuation: $430.00M

Last Raise Date: November 29, 2023

Recent Raise: $140.00M

Series: E

Pitchbook Success Probability: 97% Success

Open Roles: Careers Page

Departments Hiring Right Now:

Human Resources

Engineering

Project Management

Risk Management

Sales

So there you have it, a comprehensive dive into the earliest startup stages and what they truly entail for aspiring executives and startup operators.

Remember, venturing into the startup world requires more than just an attraction to the idea.

You need genuine readiness and excitement to embrace the unique challenges and opportunities each stage presents.

The key to success in your startup journey is not just understanding these stages but also aligning them with your own career goals and personal strengths.

The more informed you are about what each stage demands and offers, the more effectively you can position yourself as the ideal candidate – one who's not just startup-ready but stage-ready.

As you step into the world of startups, remember it's a blend of quality and quantity that sets you apart.

The more roles you consider, the better you understand where you fit best and the greater your chances of finding that perfect match.

Next week we’ll dive into Series B and beyond, but until then...

Let’s become career champions together 🏆

Kyle

Reply