- Early

- Posts

- Why Less VC Investment is Good for Your Startup Job Search

Why Less VC Investment is Good for Your Startup Job Search

JOB SEARCH STRATEGY

Doom & Gloom For Startups?

The startup fundraising headlines look bleak.

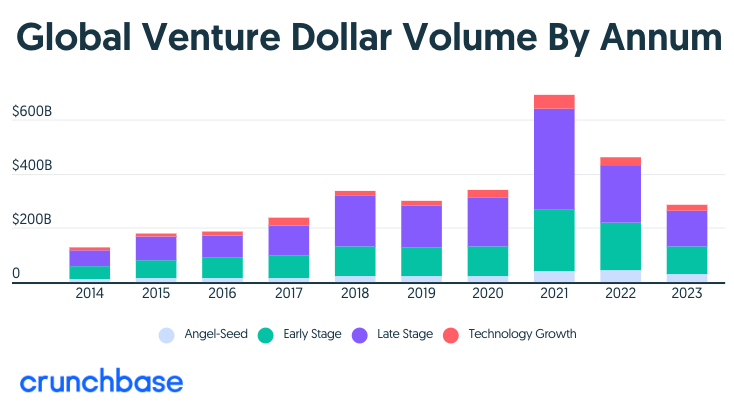

2023 saw the lowest level of venture funding in five years.

By November 2023, 543 Carta startups had shut down operations.

That’s 6x more shutdowns than 2022.

We will likely see more startup shutdowns in Q1 and Q2 of 2024.

We’re already seeing layoffs at Google and Amazon.

And with all of this going on, you may be saying to yourselves, “screw startups”.

But I’m here to say.. not so fast my friend!

Giphy

I have an optimistic take on why this is an amazing time to be looking for your next startup home and why it can lead not just to more stability in your next role, but a more lucrative financial outcome.

Read on to learn why…

ZIRP FALLOUT

Mo Money Mo Problems.

When you look at the past 20 years, we have seen two periods of ZIRP.

No, ZIRP is not the bad guy from the Toy Story films.

ZIRP stands for zero interest-rate policy.

What does that mean?

In short, it means that the Central Bank (the institution that manages the US currency and monetary policy) lowers interest rates to zero or near zero to prop up the economy and stimulate economic growth.

This means that investors can’t get good returns from traditional savings and fixed-income investments (aka bonds), so they look for higher returns elsewhere (like startups).

Initially, it was driven by the financial crisis in 2008.

More recently, we saw it drive startup investing into a frenzy starting in 2020 as a result of the pandemic.

We are only just now coming out of the ZIRP environment as the FED has quickly increased interest rates to combat inflation.

But wouldn’t more money going to startups be a good thing?

Not necessarily.

What resulted from the most recent ZIRP environment were some seriously negative factors regarding startup health.

Company Valuation Inflation: We saw company valuations skyrocketing over the last few years. While that may sound good, when interest rates increase and investments are harder to come by, these companies need to justify their valuations to collect additional funding or risk taking a down round. If the numbers don’t support the valuation, it would mean a significantly lower return on the investment of earlier investors, making them less likely to continue to fund the company. This also means the stock options granted to employees could be significantly devalued or go to zero.

Challenges in Assessing Company Fundamentals: With money so easy to come by, venture investors have told stories about companies who would send them a term sheet (details of the investment the company is seeking) and ask for a turnaround in a matter of hours. To put this into perspective, typical due diligence takes several weeks to months before a VC firm determines the company is investable. These companies were asking the investors to make a decision in a matter of minutes or risk missing out on being included in the funding round. Why is this a bad thing? You’re seeing the result of it now. Many of these companies didn’t have sound underlying business fundamentals, so when the cash dried up, they could no longer fund their business. This resulted in mass layoffs, major pivots, and entire company closures. As a job seeker, this made it hard to choose a winning company to join because so many companies looked like they were growing massively and had the war chests to match when, in reality, they were lighting money on fire.

Unsound Business Strategy: With so much capital, companies made massive bets to justify their bloated valuations and spent money like it was going out of style. They hired massive teams and increased their burn rates, expecting that the next round of funding would be easy to come by. When all that changed, the companies faced a harsh reality that their burn rate was unsustainable, hence the major layoffs, cutbacks, and company closures.

That’s the bad that came out of low-interest rates and the historic levels of money that went into venture-backed startups in the last few years.

Now for the good news.

SILVER LININGS

The Future Is Sound.

What has come out of this boom and bust cycle of startup investing has been…

A return to “normalcy”.

Better Investment Analysis: Venture capital firms are spending more time evaluating investments to ensure the company has sound underlying business fundamentals and the chance to become something big.

What This Means For Job Seekers: While not a silver bullet, you can take comfort in knowing that if you’re targeting companies that recently raised money, the investors took their time to evaluate the company. That means you’re less likely to join a company, get inside, and realize it was all smoke and mirrors. You’ll still want to do your due diligence and ask questions about run rate, burn rate, and future investment strategy when you’re speaking with the team but there should be less volatility than there was in the last few years. The investors don’t want their investments to go to zero just as much as you don’t want to be searching for a job due to mismanagement of cash and poor business management.

More Early-Stage Companies and Early-Stage Funding: Many laid-off tech workers are not heading to their next FTE role. They’re starting companies. Investors like Jason Callacanis, an early investor in Uber, have invested in more early-stage companies in 2023 during this market than ever before.

What This Means For Job Seekers: While it’s not everyone’s cup of tea, you can find an early-stage company that will give you more access to the founders, fundraising, and company building than large, later-stage companies. This is great for anyone toying with the idea of becoming a founder someday. Also, if you join one of these companies and they make it (no guarantees) your equity could be worth a significant amount.

Larger Focus on A Path to Profitability and True Product Market Fit: Investors have seen too many companies try to buy their time to figure out a profitability strategy using VC dollars. During ZIRP, the mentality was “growth at all costs.” Now it’s very clear the costs of that growth are high. So it’ll be harder for companies to get funding unless they have a clear path to profitability. Profitability is sexy.

What This Means For Job Seekers: A lot of the same message here but a better path to profitability and true product-market fit means that your job as an operator will be “easier” (although nothing is easy in a startup) and these companies would be less “risky” (although there’s always risk in joining a startup since most don’t make it.)

So, in summary:

There’s less money going out, which means that the companies who are able to raise money will likely have a more sound business than companies over the last few years, making your next startup role (slightly) more stable.

More stable companies with a path to profitability and better product-market fit mean that your equity has a better chance of being worth something.

You can get an amazing founder-like experience by joining the many early-stage companies emerging and getting funding in this new environment.

For those reasons, I’m incredibly excited for the people I’m working with in the Early Accelerator and all you startup job seekers looking for your next role.

Investors have described the current environment as similar to the environment that spawned companies like Uber and Airbnb and while the odds of joining the next Uber and Airbnb are low, they’re higher than they have been in the last five years.

OPEN ROLES

Who’s Hiring?

What They Do: FINN operates a car subscription platform that offers flexible, monthly car rentals, making it easier and more sustainable for people without cars to access mobility without the hassles of ownership.

Number of Employees: 434

Total Raised To Date: $658M

Last Known Valuation: $1.7B 🦄

Last Raise Date: January 11, 2024

Recent Raise: $109.67M

Series: C

Pitchbook Success Probability: 97% Success

Open Roles: Careers Page

US Departments Hiring Right Now:

Risk Management

What They Do: Sway offers convenient, digital shipping services for returning online purchases, allowing customers to easily send back items from home.

Number of Employees: 82

Total Raised To Date: $25.48M

Last Known Valuation: $25.98M

Last Raise Date: January 11, 2024

Recent Raise: $19.5M

Series: A

Pitchbook Success Probability: 89% Success

Open Roles: Careers Page

Departments Hiring Right Now:

Operations

Central Operations

Support

Account Executive

What They Do:

Luma AI develops software that turns smartphone photos into realistic 3D images, enhancing experiences in e-commerce, real estate, and gaming with mixed-reality technology.

Number of Employees: 24

Total Raised To Date: $67.23

Last Known Valuation: $100M

Last Raise Date: January 9, 2024

Recent Raise: $43M

Series: B

Pitchbook Success Probability: 93% Success

Open Roles: Careers Page

Departments Hiring Right Now:

Engineering

Marketing & Brand

Creative

Research

So there you have it, why I’m bullish that this is the best time to be searching for your next startup role.

Less bloat.

More sound business fundamentals.

More sobriety in spending.

I would look to focus on companies that are able to raise money in this environment and who have products that are solving a real problem.

If you want a way to assess these companies look at the questions Initialized Capital asks when assessing an investment and ask those to yourself.

Let’s become career champions together 🏆

Kyle

Reply