- Early

- Posts

- What You Should Know About Series B to C+: Navigating The Startup Stages - Part 2

What You Should Know About Series B to C+: Navigating The Startup Stages - Part 2

Where growth rapidly increases and cash falls from the sky

JOB SEARCH STRATEGY

ENTERING FINAL ROUNDS.

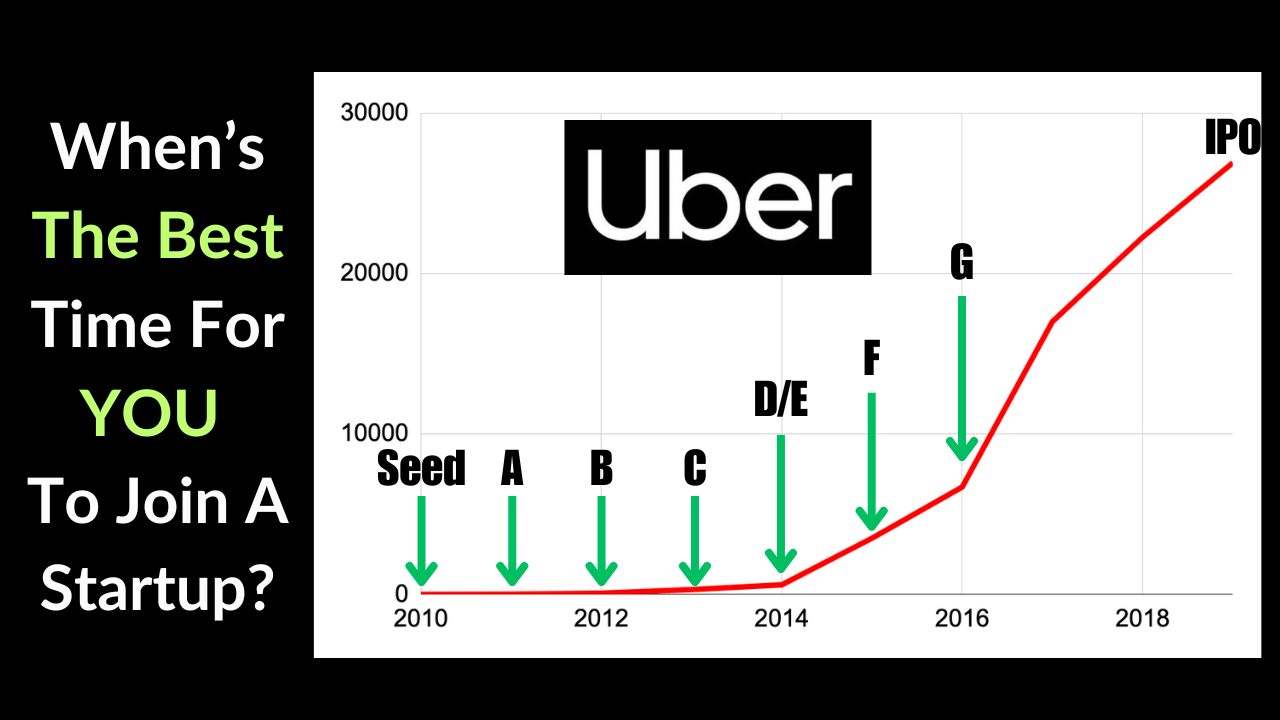

Last week, I looked into the early stages of Pre-Seed, Seed, and Series A startups, where it’s just a few people in a room hustling to bring an idea to life and scrape together a few million dollars.

This week, we will discuss Series B, the final early stage, and Series C+, where growth rapidly increases and cash falls from the sky.

I joined Uber during the Series B stage and had an incredible experience.

Now, let's delve deeper and learn more about these later stages and why they may or may not align with your career goals.

The Series B Uber NYC Operations team in May of 2013.

SERIES B

SCALING NEW HEIGHTS.

Startup Snapshot: We’re teetering on the edge of what most consider “early stage.” With proven product traction, it’s now all about proof of scale. Sure, the company has excellent metrics in your little early market. But can it sustain those metrics as it scales across the US? Across the world? Across different verticals? The number one focus is growth in revenue, customers, and as a result, team size.

Funding: The old mantra used to be “growth at all costs.” With the renewed investor focus on quicker paths to profitability, that could be rephrased as “growth at sustainable costs.” The one constant is GROWTH. These rounds average $46 million but can reach heights of $300M (Zynga in 2010) depending on how rapidly the startup wants to grow.

Product: The main focus is that the initial product grows really quickly. But focus will be put on expanding that product into new markets as well as creating new product offerings or new verticals.

Team: Mo money, mo headcount. The team rapidly expands from a few dozen to 50-60 or upwards of 150+. I joined Uber just before the company announced its Series C as the 250th employee. So, if you join a rocketship, these numbers can get large fast.

Customers: The company has identified product market fit, meaning it’s clear that people want to buy what they’re selling. Now it’s less about knowing who you’re selling to and more about optimizing things like pricing and customer acquisition.

Revenue/Profit: Growth comes at a cost. That likely means the company isn’t profitable. However, at this stage, companies typically bring in $10M-$50M in annual revenue.

Success Rate: After raising a Series B, most companies don’t look to raise another round for roughly two years. There’s a 35% failure rate after raising a Series B, so you have a 65% chance of your equity being worth something (this also depends on cap table structure and value at exit).

Pros of Joining:

Salary Closer to Big Tech: If cash is important, that component will be closer to Big Tech than in previous rounds.

Strategic Leadership: This is still early enough that you’ll be able to influence broader company strategy and expansion.

Team Expansion: Get first-hand experience scaling the team and operations. This is true “one to ten” experience (Pre-Seed/Seed and even Series A would be considered “zero to one”).

Market Presence: If new market and product launches excite you, this is where the fun happens. You’ll help the company establish a more significant market footprint in Series B.

Good Equity, Less “Risk”: You’ll still be granted a good amount of equity, but your upside won’t be as high as those who joined earlier.

Cons of Joining:

Less Equity Upside: Depending on your package, you could make meaningful equity if the company is worth tens or hundreds of billions. If not, your stake won’t be incredibly lucrative.

Complexity Management: Sometimes growth hurts. As the organization scales, so does the organizational and operational complexity. The company starts to gather new titles, new levels, new teams, and often more bureaucracy.

Sustaining Innovation: Keeping the innovative spirit alive amidst growth can be a challenge. Once you find what works the easiest thing is to just do more of that. It takes more effort to convince people to try new ways.

Increased Scrutiny: There are more eyes on company performance, so there’s little forgiveness for individual underperformance. As a leader, you’ll be judged on how well you can take the company toward Series C and IPO.

What This Means for Job Seekers:

In General: Series B has all the startup upsides with less downside. You won’t have had to go through the pain and stress of creating the MVP, getting early product-market fit, and raising the initial rounds of funding without any proven results. That pain and stress will be replaced by the pain and stress of doing everything possible to drive rapid growth. There will be a clearer path forward, you’ll have more money at your disposal, and the founding team will be more open to spending it on growth. But, that comes at the expense of the equity upside and increased performance expectations.

Junior Talent: Proving that you’re a hustler willing to do anything it takes to get the job done can win you a job in a Series B company. But this is the last stage where that will be true. After this, they will look for mostly specialists, not generalists or inexperienced hustlers.

Mid-Level Talent: A great place to be to get a bump in scope and responsibility and learn directly from more experienced startup executives and founders and get exposure to fundraising. You may still be able to make significant title jumps like Sr Manager to Director or VP, but competition will get fiercer.

Executive Talent: There is an expectation that you know how to scale an organization and operate at scale. If you’re able to land an opportunity and scale a company from Series B to and through Series C you’ll gain incredible company-building experience that can prepare you to found and scale your own company. You’ll be able to get a good salary and equity package often without taking a massive haircut on previous compensation. But, it’s less forgiving than previous stages and there’s often a short leash, so you’ll need to drive quick results.

CAUTIONARY TALE: In a previous startup where I worked, an executive was hired to run a division of the company. He came from a large established public company with a big name and had a flashy MBA from a top school. 3 months after closing the Series B he was fired. Why? He knew how to operate a large publicly traded company but was out of his league when it came to understanding what was necessary to scale a startup. If you’re looking to do well in a Series B startup it is essentialy you become a student of growth.

The Series C Uber NYC team in Nov 2013.

SERIES C+

THE STRATEGIC EXPANSION.

Startup Snapshot: Once the company has raised Series C funding, you could consider the company “successful.” At this stage, it has been clear they can develop a product, grow and operate it and others at scale, and continue that growth path. The Series C funding pours more gasoline on the growth fire to make the company a household name.

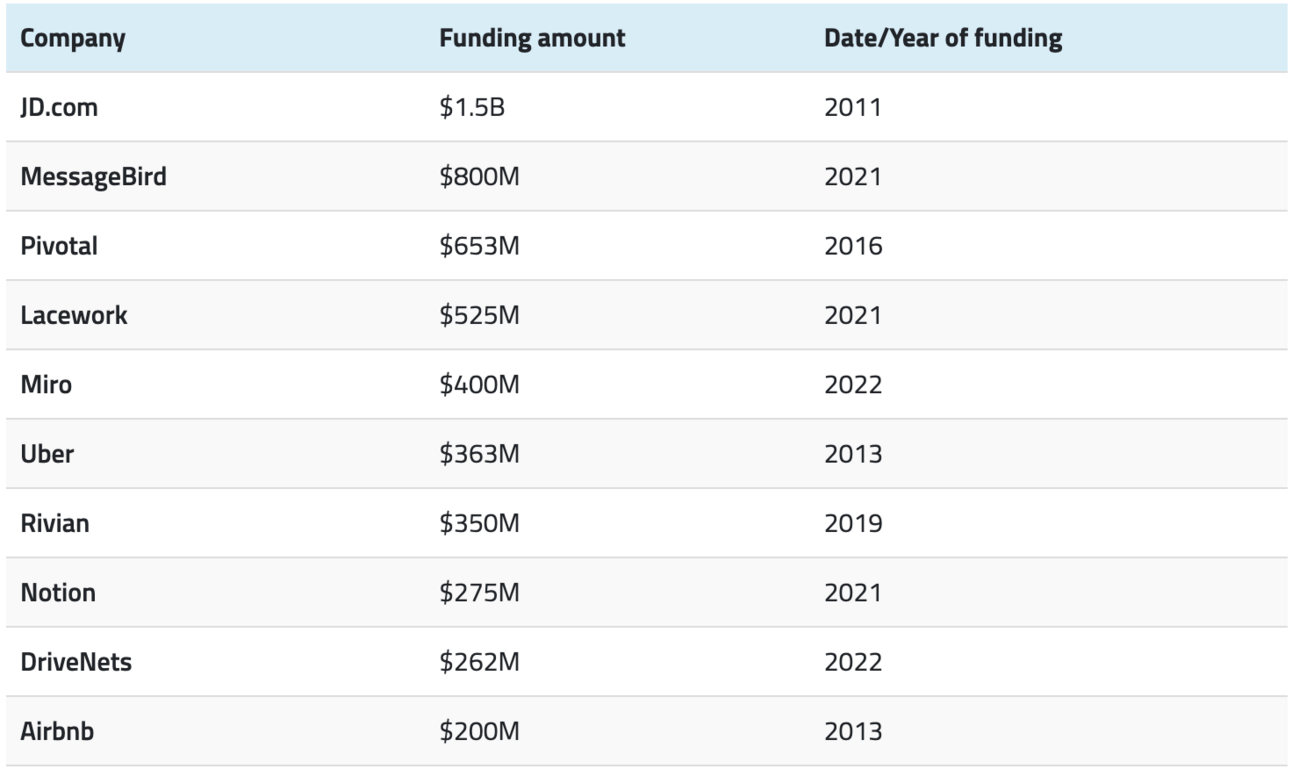

Funding: Average funding for a Series C round is $50 million however this is where the numbers can get pretty crazy. JD.com raised $1.5 billion in 2011, MessageBird raised $800M in 2021, Uber raised $363M in 2013. The numbers have gotten rather large in 2023 saw a significant decline.

Sarath/EQVISTA - Top 10 Highest Series C Funding Rounds

Product: The product is well established and people will often recognize the name when you say it.

Team: Team sizes will typically be in the hundreds, although they can reach 1k+ for some companies. When Uber raised its Series C in 2013, there were about 300 employees. By the time they raised their Series D, headcount had doubled to 600 employees. When they raised a Series E, headcount had skyrocketed to 3,500 employees.

Customers: There’s a wide customer base. The company knows its core customers and how to cater to them and are finding new ways to serve them as well as find new customers to serve.

Revenue/Profit: Valuations often cross a billion dollars at Series C giving the company the coveted title of “unicorn.” This means revenues have possibly crossed into the $100M’s.

Success Rate: Only 1% of Series C companies fail. The odds of some exit, whether IPO or acquisition, are very high, meaning that you have a higher likelihood your equity will be worth something once the company reaches this stage.

Pros of Joining:

Market Leadership: You’ll be guiding the company toward industry dominance instead of figuring out if you can even compete.

Global Impact: Get exposure to operations outside of the US and possibly get the opportunity to drive international expansion and large-scale initiatives.

Salary Increases: The company can now afford to pay very close to Big Tech salaries and industry benchmarks, so your cash compensation package will be lower but not in a meaningful way.

Very Little Risk: The early team took the bullet so you didn’t have to. While it’s possible a calamity can strike a company of this size the odds of it are incredibly low. Job security is very high.

Proven Name Brand: Get into a Series C company and you’ll have a logo on your resume that many people in the industry will recognize.

Proven Name Brand: Get into a Series C company and you’ll have a logo on your resume that many people in the industry will recognize.

Cons of Joining:

Separation From Leadership: In the early days you’ll be bumping elbows with the CEO regularly. As the company gets larger and larger those opportunities will decrease for new joiners and additional layers will be put in place inside the company.

Bureaucratic Challenges: On-the-spot promotions, random raises, and spontaneous equity grants will no longer be a thing. Formal review processes, leveling, and formal salary bands will be implemented to allow the company to scale appropriately. This is good for structure but makes advancement more of a process.

Maintaining Growth: There’s still a lot to learn inside a Series C company but you’ll be quicker to hit a ceiling than previously. It’ll be harder to make major career-advancing jumps. If the company is growing there will still be room for upward mobility but you’ll need to chart your own path.

Decreased Equity Upside: Less equity will be granted and the value of that equity will be lower. I joined as the $250th employee at Uber right before the company raised a series C and the equity ended up being worth a few million dollars (life-changing for me). The share value of those who joined after me was in the tens or hundreds of thousands.

What This Means for Job Seekers:

In General: Many people within the tech scene will have heard of Series C companies. Investors give big checks because the operation is less risky. While less risk is great for stability, it’s also great for opening the floodgates to all the competition who weren’t ready to take the risk of joining an early-stage company. Job seeker competition at Series C companies is fierce because everyone wants that hot up-and-coming name on their resume and to join a “sure thing” company before the IPO. With significant competition, it’s critical to do everything possible to stand out.

Junior Talent: At this stage, you may not be able to get into the company as a manager and may need to settle for an associate or coordinator position. This is still a great time to join a startup because you’ll be able to see what the company looks like at scale and learn from more experienced mid-level managers.

Mid-Level Talent: Join early in the Series C stage and you’ll still have a good chance of driving results and being given more responsibility. The great thing about this stage is you’ll have more resources at your disposal. You’ll have the freedom and flexibility of a startup and the financial backing of a big tech company. You’ll also be able to learn from great executive leadership and possibly even have a budget for personal education.

Executive Talent: Experienced executives need only apply. This is not a training ground for new executives to cut their teeth. These trained professionals are going to take the company to the next level and prepare it for IPO. Many of the executive positions will have been filled by early employees so you’ll need an impressive track record of startup success to land an executive role at a Series C company.

CAREER PROGRESSION: I joined Uber as an Operations Manager in 2013. In 2017, on paper I was still technically an Operations Manager. My scope, scale, and responsibility had changed dramatically but my title had not. This was not uncommon at the company as organizations were kept intentionally flat. The people who advanced the fastest or jump between departments were able to relocate to HQ in San Francisco. While I didn’t have a title change for 4 years at Uber (2013-2017) within 3 years (2017-2020) I would become a VP and run all of operations for a Y-Combinator startup showing it’s less about title and more about the skills, experiences, network, and teachers you have access to.

So there you have it, each stage, from the earliest stages of an idea through giant war chests to deploy for growth.

The earlier stages typically provide:

Accelerated learning opportunity

Increased exposure to new experiences and higher levels of leadership

Significant equity upside

More building

Less structure

Less candidate competition

The later stages typically provide:

More certainty and security

More cash

More structure

Less equity upside

Less exposure to higher levels of leadership

Significant candidate competition

If you have any questions about which stage is best for you or you’re considering making a move into startups don’t hesitate to send me an email at [email protected].

My goal is to help as many people as possible live the same experience I had when I joined the Uber rocketship.

Let’s become career champions together 🏆

Kyle

Reply