- Early

- Posts

- The 500 Most Important Startups To Watch

The 500 Most Important Startups To Watch

The TWiST 500 Database

JOB SEARCH STRATEGY

THE 500 MOST IMPORTANT STARTUPS.

After a month with my kids and focusing on the startup job seekers in the Early Accelerator, I’m back!

We spent a week upstate New York catching salamanders, frogs, and fish and floating the Delaware River, then took a trip to Seattle to visit family and friends (and get a couple of rounds of golf in).

Somehow, I always forget the magic of summers in the Pacific Northwest.

We always used to say the best-kept secret was the summer in the Northwest.

I guess it’s no longer a secret, given Seattle’s population is set to break 800k by April of 2025, potentially surpassing San Francisco in the process.

But enough about me and my love of my hometown of Seattle.

You’re here for one thing and one thing only - to land that next career-accelerating startup role.

So let’s dig into this week's newsletter, where I’ll share…

A resource providing a list of 500 of the most important startups in the world

Why this list is relevant to you as a job seeker

How to use the list to land your next role

THIS WEEK IN STARTUPS.

If you’re working in a startup, searching for a job in a startup, or just interested in startups and you’re not listening to the This Week In Startups podcast, you’re missing out.

Every week you get:

Product demos

Interviews with founders

Conversations with top investors

Recent news about startups and tech

It’s one of the many podcasts I listen to religiously to keep my finger on the pulse of the startup ecosystem.

The podcast is hosted by Jason Calicanis (X) and Alex Wilhelm (X).

Jason Calacanis

Jason Calacanis is an entrepreneur, angel investor, and author.

He began his career in the 1990’s as a journalist and publisher in the burgeoning tech and startup space in New York.

In 2003, he co-founded Weblogs, Inc., a network of blogs that he sold to AOL two years later for approximately $25 million.

That led him to angel investing, where he was one of the earliest investors in companies like Uber, Robinhood, Wealthfront, and Thumbtack, making him one of the most successful angel investors ever.

His $25k investment in Uber alone is worth an estimated $100 million, and his total returns from his angel investments could exceed $500 million.

He wrote a book about angel investing titled Angel: How to Invest in Technology Startups and is one of the four hosts of another incredibly successful tech, startup, and political podcast The All In Podcast.

Alex Wilhelm

Alex Wilhelm is one of the top journalists and editors in startups and tech.

He spent three years at The Next Web before becoming the editor-in-chief of top tech publications like Crunchbase and TechCrunch while writing his business and personal blogs.

Alex is an expert in startup funding, IPOs, and market trends, breaking down complex financial information so simpletons like me can understand it.

THE TWiST 500.

After bringing Alex to the This Week in Startups team, the two hosts have combined their startup brains to put together a list of 500 companies they’ve called the TWiST 500 (for This Week In Startups 500).

Here’s how they describe the list on the website…

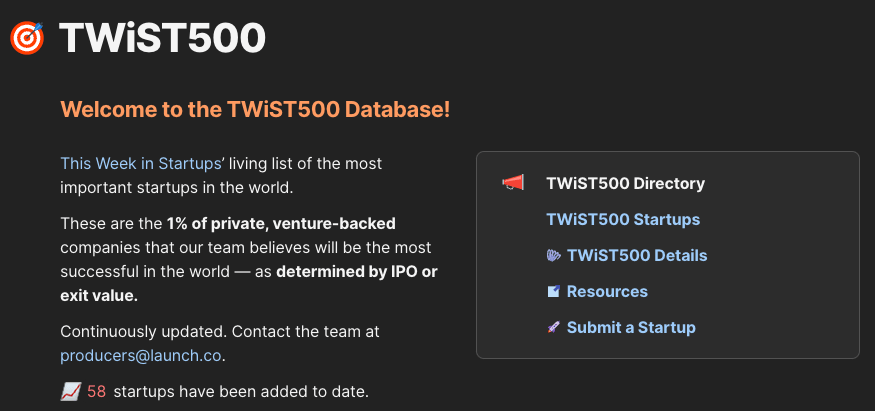

“This Week in Startups’ living list of the most important startups in the world.

These are the 1% of private, venture-backed companies that our team believes will be the most successful in the world - as determined by IPO exit value.”

A great thing about the list is that it’s filterable.

You can filter the list by:

Stage

Category/Industry

Prediction (eg. Heading for Series A, Most likely to IPO, Filed privately, Filed publicly, One to watch)

That filtering can be useful, especially if you have an industry or stage of expertise or interest.

The list currently consists of 58 startups, but the team will continue adding companies until it reaches 500.

WHY THE TWiST 500 IS RELEVANT.

So why does this list matter to you as a startup job seeker?

Following The Experts

Well, one of the things that scare people away from startups is the level of risk.

The stats for startup failure are widespread.

Something like 90% of startups fail, with 20% failing within their first year and around 50% failing by their fifth year.

Less than 10% of startups reach the “high-growth” or scale-up phase and the odds a company will reach IPO are between .01% and .02%.

That means that out of 10,000 startups, only 1 or 2 typically go public.

So how do you know whether the startup you hope to join will succeed or fail?

The average tech worker and startup job seeker is not an investor and doesn’t have access to the data that investors use to determine whether the company is worth the investment.

One way you can choose which companies to target would be to invest the time, energy, and money to educate yourself on startup financials and business metrics, and purchase tools like CrunchBase or Pitchbook to make your own determinations.

An easier way is to follow the lead of the people and VC firms who are investing their money to fund those companies.

That means identifying lists like the TWiST 500 or looking for which companies are receiving investment from the top VC firms that have a long track record of funding winners.

You Are An Investor

The other thing to remember is that you are becoming an investor by joining these companies.

For one thing, you will be investing the next two, four, or in my case with Uber, 7 years of your life working on this product and mission.

In addition, most (if not all) of the companies on this list will grant you stock options when hired.

Stock options allow you to purchase stock in the company at the price the company is currently worth.

If the company grows, you can see a tremendous increase in that investment.

For example, I was able to purchase my initial Uber stock options for something like $1.

That stock then went through multiple splits, and the value rose, turning one share of Uber into 20 shares of Uber.

Today, Uber trades at around $65 per share, making my initial stock option grants worth millions.

That’s the best-case scenario.

And to be clear, it’s a very rare situation.

There is a significant chance that your shares will go to zero.

I was granted enough equity in my last company that if it had achieved the same Uber heights, it would have been worth far more than my Uber grants.

But… despite raising over $80 million and being valued at close to $200 million, the company failed, and that stock was worth nothing.

So if you choose the right company and strap yourself to a rocketship, you can participate in the same financial windfall experienced by the early investors in the company.

An Important Reminder

It’s important to remember that while following insights and investments from top VC investors and VC investment firms can improve the odds that the company you join will be poised to win, it is by no means a guarantee of success.

The previous startup I worked for that went to zero had investments from top VC firms.

So use these lists to narrow your list and to choose from companies with a higher likelihood of success but also do your homework.

In a previous newsletter, I highlighted a framework Initialized Capital (one of the most successful early-stage VC firms) uses when assessing investment decisions and how you can adopt their framework to make a more informed decision when choosing which company to work for.

DON’T JOB SEARCH ALONE.

Are you frustrated by your lack of traction in your startup job search?

Do you have trouble knowing which companies are out there that match the characteristics of your ideal role?

Are you sick of doing it all on your own?

If that’s you, check out The Early Accelerator.

It’s a program and community I designed specifically for you.

It gives you everything I wish I had in my startup job search.

Direct mentorship from people who have been where you want to go

Startup job search best practices and playbooks

Lists of target startups tailored for you

Deep dive company profiles with investor-grade data

Unicorn recruiters for mentorship and mock interviews

Salary and equity benchmarks plus negotiation assistance

A community of badass startup operators looking for their next role

It’s the best way I’ve found to eliminate the anxiety, uncertainty, and loneliness of the job search while landing a role at the next generation of world-changing companies.

Giphy

HOW TO USE THE TWiST 500 LIST.

Here’s how I would use the TWiST 500 list to find my next killer startup role if I were looking today.

Get clear about what you want: Before even opening up the list, I would spend time identifying what I wanted the next stage of my career to look like and why. If you need help with that, check out my very first newsletter, where I broke down a step-by-step process to follow.

Make your shortlist: Open the TWiST 500 list and filter on the categories and stages of companies that match my ideal job and company description. Put that list of companies into a separate document (Google Sheets, Excel, Notion, whatever you like best). Include columns for a website, careers page, company size, company stage, last fundraising date, connections into the company, key employees, hiring (Y/N), and hiring for your function (Y/N).

Prioritize your list: Companies hiring for my function would be first priority. Second priority would be companies that are hiring but not for my function. Third priority would be companies that aren’t hiring but are interesting.

Go on an information diet: Create a watchlist of all the interviews with founders, execs, and investors on YouTube. Create a playlist of all the podcasts with founders, execs, and investors. Follow the founders and anyone else at the company who creates content on LinkedIn or X and turn on notifications for their posts. Live in their world to make your outreach to them and their team more effective.

Engage with their content: If people at the company or the company itself create content, I’d follow them, set up notifications, and engage with their posts (like and comment with a value-add insight). This can build familiarity with you and your social profile so they’ll recognize you and increase the likelihood of responding to a DM or connection request.

Check for connections: I’d use the LinkedIn people search to identify any first or second-degree connections I had at the company and then reach out to those individuals to see if I could get an introduction and conversation with someone on the inside.

Reach out to relevant stakeholders: I’d craft a compelling message about why I’m interested in the company, why my background and accomplishments are relevant, a quick video using Loom introducing myself, and add any additional value I can provide to the company today (for examples of value and why it’s important you can read my newsletter about free work). I’d find their emails using Appolo.io and Hunter.io and send emails first, then follow up a few days later with a LinkedIn connection request. I wouldn’t just send emails to recruiters and hiring managers. I’d expand my messages using the networking strategy I broke down here.

Apply: If a position is open and you’ve already reached out to people you know to get a warm intro, I’d submit my application with a tailored resume, cover letter, and links to an immersive CV (I’ll write about these in an upcoming newsletter).

Follow-up: If I didn’t hear anything back from my outreach, I’d send a follow-up in 7-10 days. I’d send two follow-up messages before abandoning that contact for at least a month.

Repeat: I’d repeat that process for each company I found on the list and then expand my search to more companies using the Startup Job Board Library.

There are over 58,000 private venture-backed startups with offices in the United States.

Only 580 to 1160 of them will reach IPO.

The TWiST 500 can help you narrow down the list of 58,000 to a more manageable number to focus on.

It can also give you a higher level of conviction that the companies you’re targeting have a better chance to reach IPO and, in doing so, create a life-changing career and financial result for you.

Put my process into play, and let me know your results.

I love hearing stories about people who land jobs at the next generation of world-changing startups.

So… until next week.

Let’s go get you that job!

Kyle

Reply